A budget is going to give you an action plan and clear picture of where your money is ending up each month. Budgeting will help you achieve the goals you’re working toward—whether that’s getting out of debt, saving for retirement, or just trying to keep your grocery bill from getting out of hand.

We collect 06 best practical budgeting tips from Dave Ramsey and share with you. Hope you can learn and practice.

1. Budget to zero before the month begins.

This means before the month even starts, you’re making a plan and giving every dollar a name. It’s called a zero-based budget. Now that doesn’t mean you have zero dollars in your bank account. It just means your income minus all your expenses (outgo) equals zero.

2. Do the budget together.

If you’re married, you and your spouse need to sit down and get on the same page about money. Remember: If the two of you are one, your bank accounts should be one too! It’s no longer your money or my money—it’s our money.

And if you’re single, find someone who can act as your accountability partner and help you stick to your goals!

3. Start with the most important categories first.

Giving and saving are at the top of the list, and then comes the Four Walls—food, shelter and utilities, basic clothing and transportation. Once your true necessities are taken care of, you can fill in the rest of the categories in your budget.

👉 Read on: 7 Budgeting Tips You Should Consider To Save Money In 2019

4. Have goals.

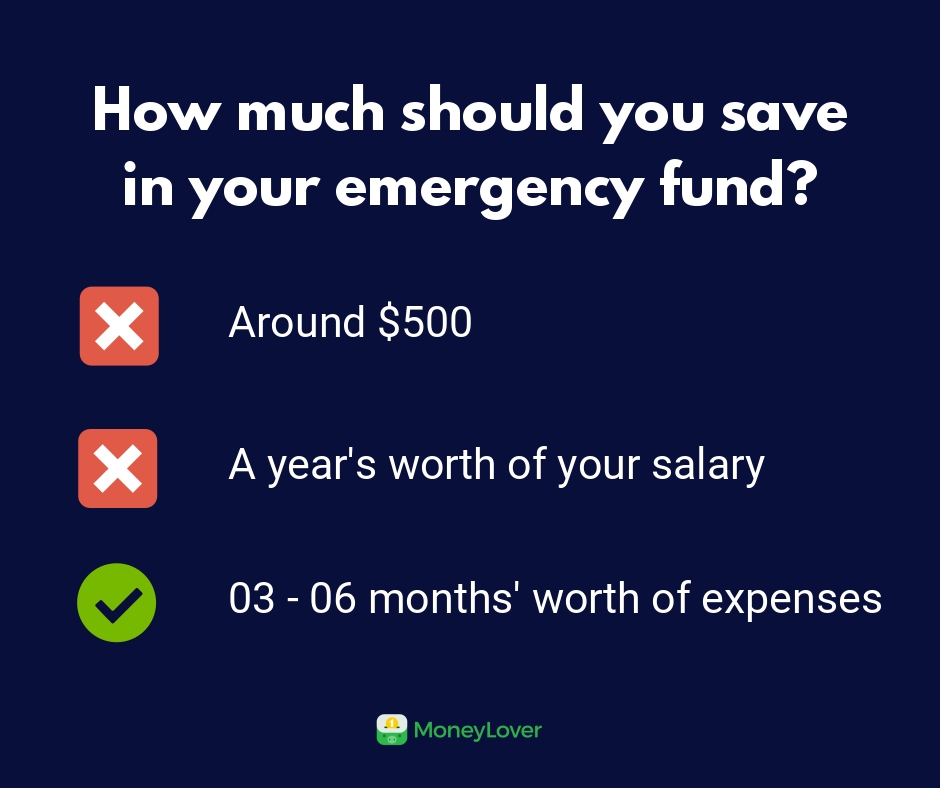

Whether you’re paying off student loans, building up your emergency fund, or paying off your mortgage, you need to focus on your why. What’s the reason you’re making these sacrifices?

5. Try an online budget tool.

If pen and paper (or spreadsheets) aren’t your thing, it’s time to join the 21st century and use a budgeting tool. You can focus on planning a budget and tracking your spending from the comfort of your smartphone! Plus, you can sync up your budget with your spouse, which is great for keeping that communication open.

6. Make a schedule (and stick to it).

While you’re making a budget part of your monthly routine, why not pick specific dates for other expenses? Set up auto drafts out of your checking account to pay bills, and buy your groceries on a set day every week or twice a month. When you know what to expect and when to expect it, you take a lot of stress and potential pitfalls out of the picture.

Source: https://www.daveramsey.com/blog/the-truth-about-budgeting