There is a question to be repeated on each Halloween: What you fear most?

Many people scared ghost. The others scared of devil, witches or whatever. For me, I worry excessively about running out of money. It’s a horrible feeling when I look at my wallet and realise I have nothing!

This is an unfortunate situation that can happen to anyone. So, it's time to go into financial survival mode. Here's a three-step plan to help you focus on the most important things now: preserving the money you still have as much as possible and finding other sources of income.

Step 1. Take Stock and Prioritize Your Spending

Take a deep breath, then take a hard look at your income, expenses, and debt, if you haven't already

Which Bills to Pay First

When money's really tight there are some bills you can let slide for a while, and others that you should keep on paying if at all possible. The ones you should pay first are the ones that would affect your family's health and security the most:

- Rent or mortgage payment: In some states, landlords can kick you out if you're even one day late on rent

- Essential utilities: gas, electricity, and water

- Child support: If you stop making those payments you risk losing custody rights and could even end up in jail

- Insurance: It's too risky to go without medical, auto, or home insurance

- Car payments: If you get behind, the lender could take your car and your credit score will drop

- Any other secured loans

- Student loans

Although it's not the best tactic, paying just the minimum on your credit cards can help you get by; just make sure you put the cards away and stop using them. Also, if you can qualify for a 0% balance transfer offer, you might be able to reduce your interest payments, but you'll need to calculate if it's worth it.

Cut Your Existing Bills

You've probably already done this, but just in case, go through your budget and ruthlessly strike out everything else that absolutely isn't necessary, such as the cable bill, gym memberships, and other non-essentials. (Even internet access might not be necessary, but that depends on your job.) This is your new emergency budget, but we can tighten it up even more.

Then call your bank, credit cards, and wireless bill to negotiate better rates. These calls can save you a few hundred dollars a year. Just about any kind of bill can be reduced just by asking, including auto insurance. Now might be the best time to shop around for better rates.

Step 2. Trim Your Most Expensive Spending

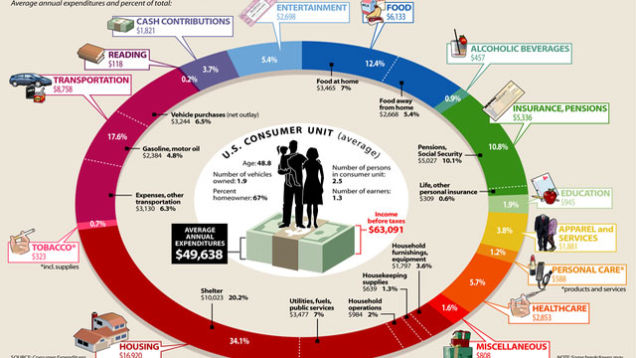

Housing: We spend the most on housing, transportation, and food, so these are the first categories you should scrutinize to save more on. Although moving might not be an option right now, it's something to consider down the line. Perhaps consider renting out a room of your home if necessary.

Transportation: Do you really need a car for work or the second car? Using alternate transportation could save you thousands.

Food: It's possible to eat well on just $1 a day or, if you're not into extreme couponing, save by creating meal plans from flyers and what you have in your pantry. Food banks (a.k.a., food pantries) can help supplement your grocery trips too. Marisa Miller, a former chef and mother of two who found herself with just $100 after bills to buy food, gas, and other necessities, has great advice on using food banks and eating smarter in general, including:

- Eat food with the densest nutritional quality, like brown rice and beans. (Learn to cook like a peasant)

- Know the pull days at your grocery (when they reduce items for clearance). Shopping later in the evening, perhaps on Wednesdays, could net you reduced prices. Miller notes that Trader Joe's pulls expired food on Fridays so the weekend is a good time to visit the food pantry they donate to.

- Get bread and produce weekly at most food pantries

Step 3. Find New Sources of Income or Cash

Sell stuff: Selling stuff you don't need, such as jewelry or old electronics, can give you the wiggle room your family needs while searching for a new job. The Simple Dollar has a story of a couple who picked up stuff for free (like tables put out on the curb) and sold them at yard sales, making more than $1,000 in one summer. Not everyone's going to get richer like that, but it's an example of turning trash into treasure.

Find temporary work: The most important thing to do, though, is to be relentless in looking for income. Tap your local unemployment agency for help and follow our unemployment survival guide. In the mean time, companies like LaborWorks (in Washington, Oregon, and Nevada) offer temporary jobs that run the gamut—from accounting to general labor—that can turn into permanent jobs. Volt is a similar agency nationwide. Do a search for "work today, get paid today" in your city for daily jobs that pay immediately.

Even small things like babysitting, tutoring, or running errands can help you stay afloat. You might sign up to become a TaskRabbit, for example, to do simple tasks in your neighborhood.

Explore loan options: If you need more cash right away, you have several borrowing options. The safest loan is from family or friends, but that depends on how comfortable you are asking them and if they could help.

Seek government/non-profit assistance: Finally, don't forget that there are government programs that could help you get back to financial stability, beyond unemployment insurance and food stamps.

That's how I overcame my fear of running out of money. What do you think? Tell us in the comments section below or share more on Money Lover fanpage

Read more:

1. The 5 retailers with the best Black Friday discounts

2. Working in Silicon Valley for a 6-figure household income, I still don't have any money