Saving money is one such resolution that’s on nearly everyone’s New Year Resolutions’ list almost every year.

Much like the ones who want to lose weight, the people who decide to clean up their finances start off with noble intentions but somehow manage to lose steam somewhere within the third month and next thing you know, their right back where they started.

However, let this year be different. Let this year be the year you actually implement it. And no, it’s not as difficult as it sounds. We give you tips on how you can save money this year without making much effort.

Say it aloud: “I resolve to…”

Track before you tackle

Everyone decides to clean up their finances just like how many of us decide to trim down your waist size. While most people try and make a budget, they only manage to scratch the surface and with the lack of discipline in sticking to it, it’s no wonder that 365 days later they are back to where they began.

Before you dive head first and set yourself an unrealistic budget, try and keep track of what you’re spending on, and where. When you’ve identified where you can cut back on, you can set yourself a much more realistic budget.

Focus on being debt-free

We have one good tip here: Pay your credit card bill in full (nothing better than the whole amount) and not be tempted to pay just the minimum amount. If you pay only the bare minimum, you will be charged with hefty interest fees and enter into a vicious circle of credit card debt.

Cut down on your small pleasures and guilty vices

That gym membership you haven’t used in a while, the daily taxi to work and that delicious cup of Koi that you drink everyday – expenses like these should be relooked at. While they may appear to be tiny expenses, if you calculate, you can save a substantial amount if you cut down.

Smoking is another vice you can do without. While smoking might be viewed as a pleasure for some, the reality is that it is a harmful and expensive vice. Cigarettes in Singapore aren’t cheap either. Forget about a year, when you tally up how much you’d be spending on it over the span of a month alone you’d be astonished by how much you could save. Not only will you be able to save but you’d be able to live longer to enjoy it.

👉 How to cut your spending with Money Lover

Reduce important shopping

We all have impromptu shopping flings. However, too many of these can be dangerous for your finances. Try to buy things only when you need them or better yet, hold out for a big sale and buy your item on a discount.

Plan vacations in advance

We all know how much cheaper it is to book flights in advance vs last-minute flight bookings. Also, early bird hotel offers have their own benefits. So, the next time you want to take a trip, plan months in advance. Make sure you use a credit card to get rewards, plus research on deals or discounts that your credit card may have with your preferred online booking site.

Save as a family

You might want to shower all the luxuries of life on your children but the greatest thing you can do for them is to teach them the value of money. Each month, set an allowance for them and ask them to spend within that. This will not only set a strong financial foundation for them but will also help you save as a family.

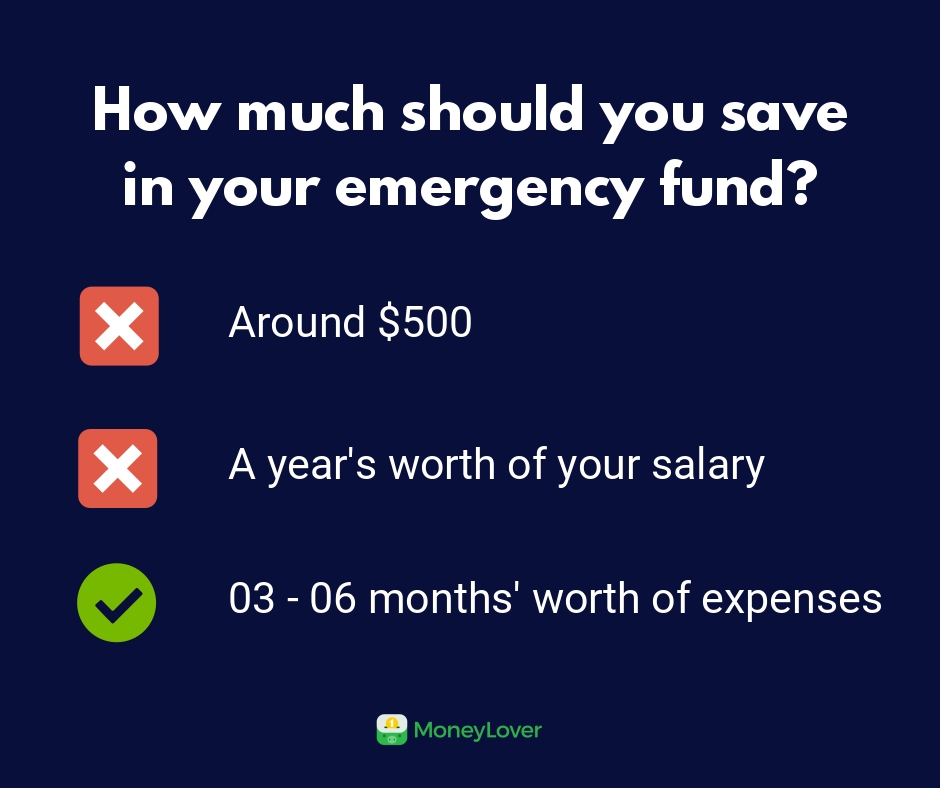

Start an emergency fund

A sudden medical emergency, a retrenchment or an unfortunate damage to your house due to water leakage – anything can happen anytime. These emergencies pop up out of nowhere and turn your budget planning upside down. To avoid that, you need to start saving a small amount every month and not use it until there is an utmost need to.

Review

Just like you would have to review your work performance, reviewing your budget and plans on a periodic basis is a must. Timely reviews will tell you how you’re progress has been and how much closer you are to your goals.

Fallen off the wagon in the past 2 months? Don’t fret, knowing what went wrong gives you enough time to correct your course. Reviewing your plans every two months will also ensure that you don’t lose steam and get discouraged with minor setbacks.

Start learning about investing

If you haven’t already started, make 2019 the year you commit to growing your money. After all, there’s no point having a New Year resolution about saving money when we’re struggling to make ends meet, right? Being in the stock market is important if we want to achieve financial freedom.