Budget, simply, is a plan to spend money in week, month or even year. Reasons why you should have budget:

- Find ways to spend less money, so that we can save more money

- Find out whether our spending is really as low as it can go and determine that we need to make more money to afford our life

- Determine if we can spend less in one area, so that we can spend more in other areas of life: shop less = travel more :).

Read on: 03 common budgeting mistakes most young people have

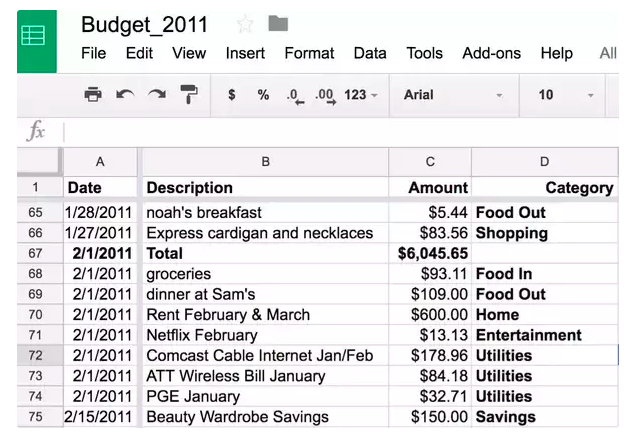

Track what you spend

Budgeting does begin with tracking what you spend. You can start with pen and paper, with mixed results, and then used software like Excel, and then Google to set up budget spreadsheets.

Advice: You need to track your money from all different sources of income and expense such as bank accounts, cash, credit card.

Mobile app/ software like Money Lover helps you to deal with it in a simplest way. No more pen and paper or complex Excel sheets, you can easily keep track of your expenses and income and label them in category such as food, beverage, or salary.

Use your data to budget

Use that “data” of your weekly/ monthly expense to see how much you spend in each general area of your life. This means you “assign” a category to each item you spend money on. The major life categories could be: home, transportation, food, children, insurance, misc. Use the budget, and see how you “feel” about each area of spending.

Let answer following questions:

- Do you like how you spend your money? Are you happy with your purchase history or not?

- Did you overspend or need to save money next month?

- What changes would you make? For example: cut 50% spending for shopping and spend more on books.

- Can you set “new limits” on certain categories next month?

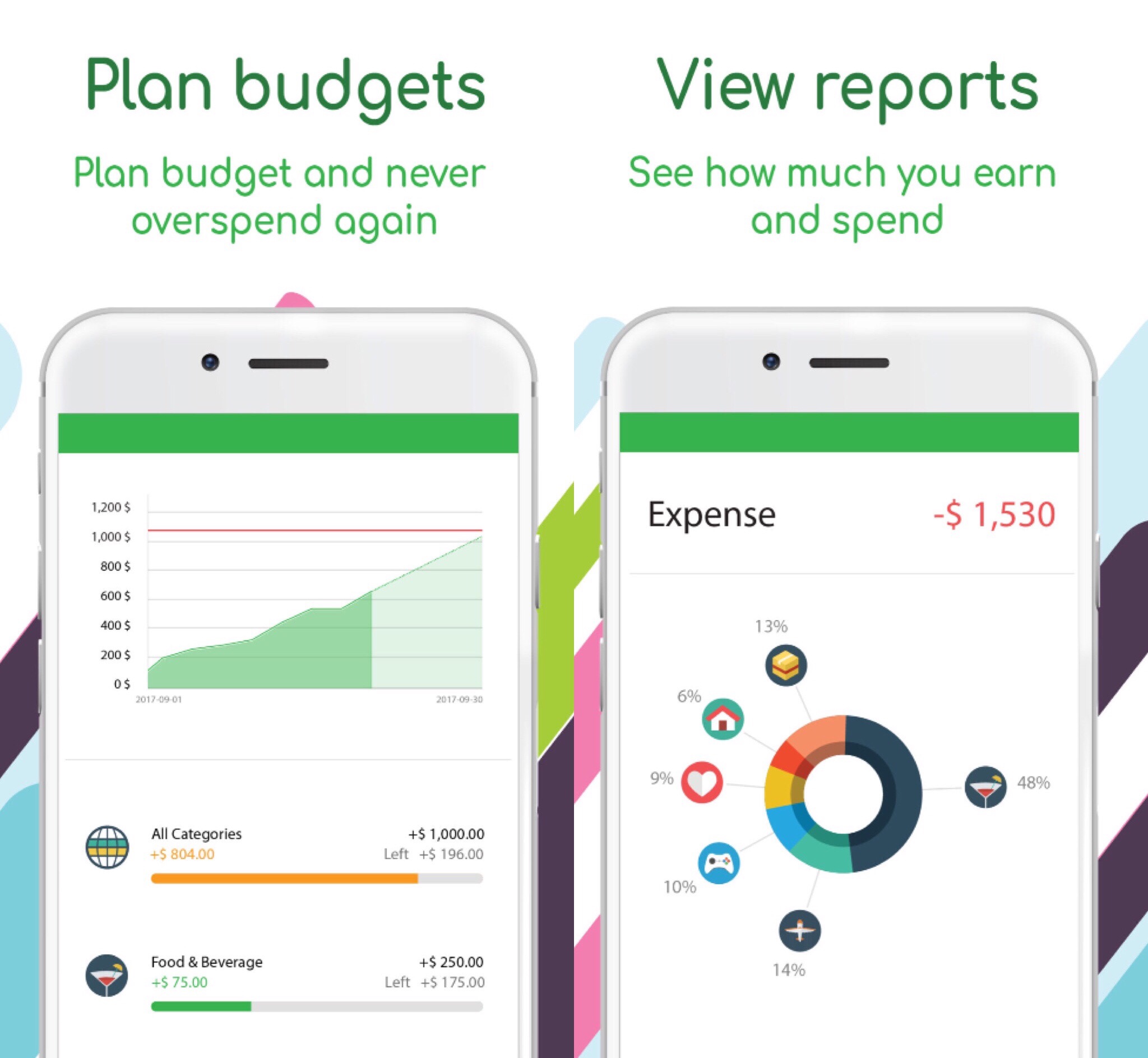

How Budget with Money Lover

Money Lover is the best mobile app that helps you track your money and plan budgets wisely. See the advantages of Money Lover compared to Excel or pen & paper.

Track your expense, income and group them in category like Food, House, Shopping.

View reports to understand how much you earn and spend in a month/ week or how much money you spend for Food & Beverage last month.

Setup budget plans determine how much you plan to spend in the upcoming month for each majory category.

Stay alert. In case you're going to overspend, it will let you know via notifications then you and decide and plan your expense to the rest of the month/ week.

Found this blog's useful? Please hit SHARE to let your friend on social media learn how to budget their money.

Link to download Money Lover

Note: This blog was inspired by the post of Elizabeth May on Quora.