Managing finance needs experience and exposure to financial opportunities. When we see our generation Y, most of them are continually struggling to manage their finances.

If you are in your 20s and want to maintain your finance efficiently, then here we have some amazingly convenient and simple tips for you. So keep on reading to explore more.

Manage your debts

So, one of the most concerning issue that most of the young adults have to face is debt management. With the changing trends towards credit cards and instant loans, our generation is getting more addicted to these menaces. Although we believe that having a credit card could be your financial backup plan, however, then you have to decide a limit on the usage.

👉 Related: Manage small debts with Money Lover

Emergency account

Although it is highly advisable to have a saving account for the great endeavours in life including marriage, college admission and many more, however, this is not it. If you are investing in a saving account, you are binding your money for a significant period.

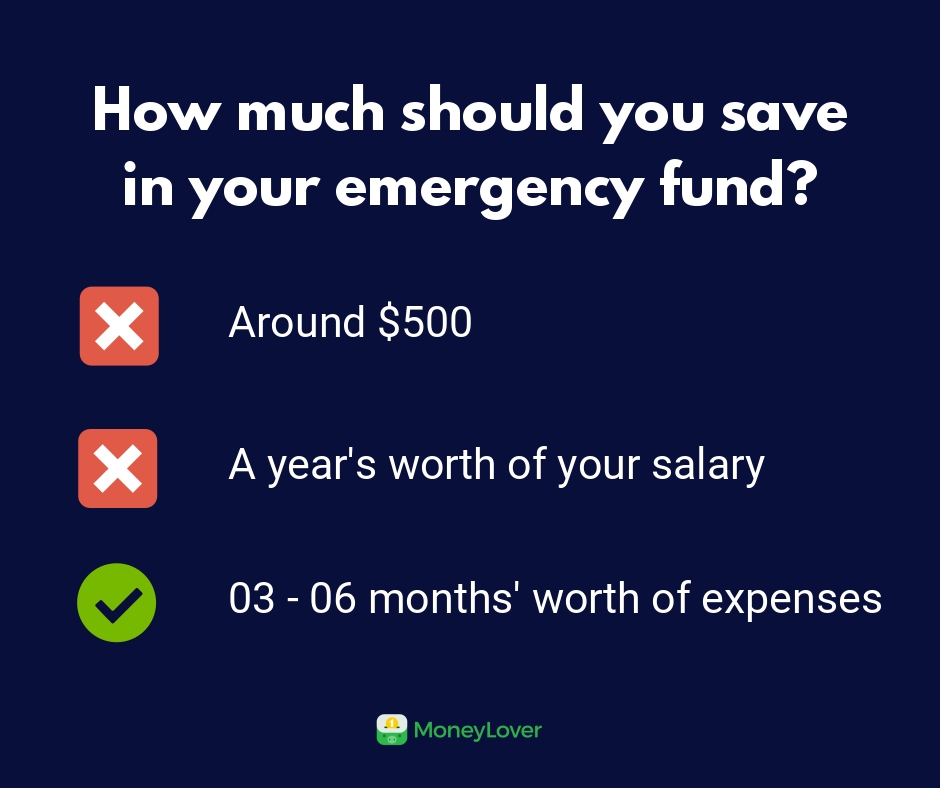

We should not forget that life is full of surprises and uncertainties. So it is essential to keep a few bucks aside from the routine expenses to be used in case of an emergency including the medical one. If you have already put some money aside then in case of any financial emergency you do not have to seek assistance from external resources.

Saving account is must

Having a saving account is the wisest decision in all of our lives. If you have extra money, then you should go to a financial institution to open a saving account. Keeping money in a drawer is not a wise decision instead go for a saving account and earn interest on your savings.

Control your expenses

One of the highly concerning issues in the young adults is to control their expenses. Whether it is shopping or some other event keeping the expenses in check is extremely important. So make your budget and spend according to your budget limit to avoid overspending.

Furthermore, with the introduction of online shopping and events like Black Friday and Cyber Monday, even a thrifty person feel the urge to spend in excess. With smartphones and the ease of a single click, we have to be very strict with our spending.

👉 Related: DO's and DON'Ts this Black Friday

Craft a budget

We are adding this tip, but it does not tarnish its importance. Creating a budget helps you to be in the right lane. To make a budget, first, you have to realize your income and expenses and then adjust the primary and less important expenses accordingly.

Plan your retirement

It is highly pertinent to plan for your retirement as soon as you find your first paying job. Almost every company offers a retirement plan for the employees. It is then up to you to go with the plan or take a leap ahead and invest some extra bucks for your future.

In this writing output, we have discussed some of the tips to assist young adults in financial management. If you have any other idea, then let us know in the comment box below.

👉 Related: Personal Finance Management Check-list

You can get Money Lover on Android and iOS or Web version and start managing your finance from today.