How to use money wisely and have a happy life is a big question of millions people, especially the young with low or middle income.

50/30/20 may help you to put your budget on the control.

1. What's 50-30-20?

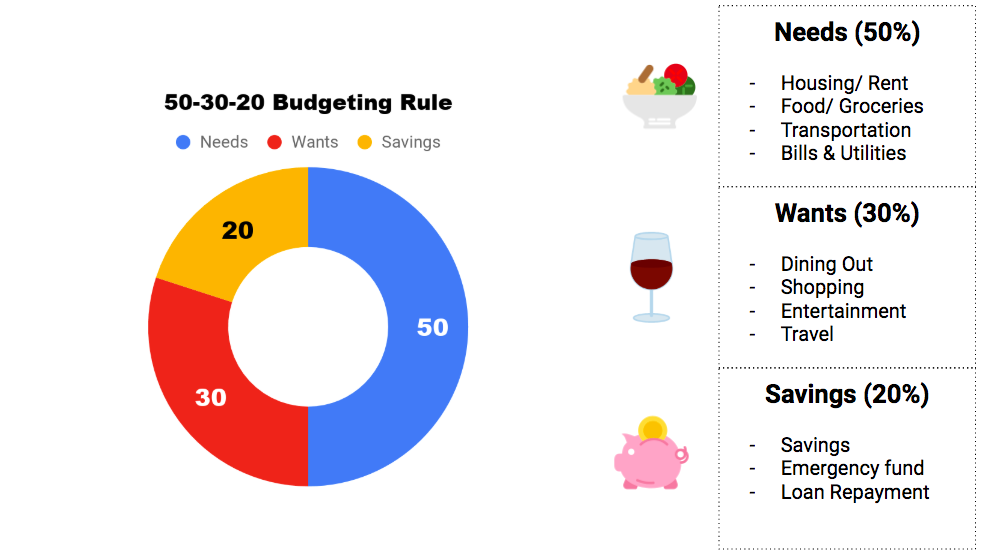

50-30-20 is a super-simple rule to plan your monthly budgets with THREE major categories.

Needs - 50% are essential things you need for your life (or survival) such as Food, Housing, Water, Gasoline, Electricity, etc.

Wants - 30% are things you may want but could live without. They're flexible spending categories depending on your lifestyle. Most of them make you feel happier like Movies, Travel or even Games.

Savings - 20% of your net income could be allocated to saving account for emergency situations or pay off your debt or credit card.

It seem really easy, but is it possible for everyone? Let's take a look on 2 sides of a coin.

2. Pros

Simple: You could find other rule is easier than it. Just allocate your money into three big categories and follow the rule.

It's better than no plan: 2/3 of young people do not plan any budget. Have a plan on how you spend your money still better than do nothing.

3. Cons

It could not work for all level of income. For students or junior employees, they have spend 80% of they income for the needs. It means lower savings and less shopping.

Lots of people have to spend 40-50% of paycheck to pay off the debt and cut living expenses as much as possible. For example, for someone who plans to by a house or get a new car, 20% saving is to small and no meaning.

80 percent of the young professionals are not able to follow the budgeting they had planned) because they're not realistic. Before budgeting, you have to track your daily expense and list them in categories to understand your needs, wants and how much you have left for saving.

50/30/20 is just a preference, (it could be 45/25/30) so you have to adjust to fit with your financial status such as your income after tax, short & long term plans. Check out Personal Finance Management Checklist if you still do not know where to start managing your money.

Read on: Living with a tight budget tips

Money Lover is simple expense tracker and budget planner that helps you stay on top of your finances and save more for future.

You can get it on Android and iOS or Web version and start applying 50/30/20 rule in planning your next month budgets.